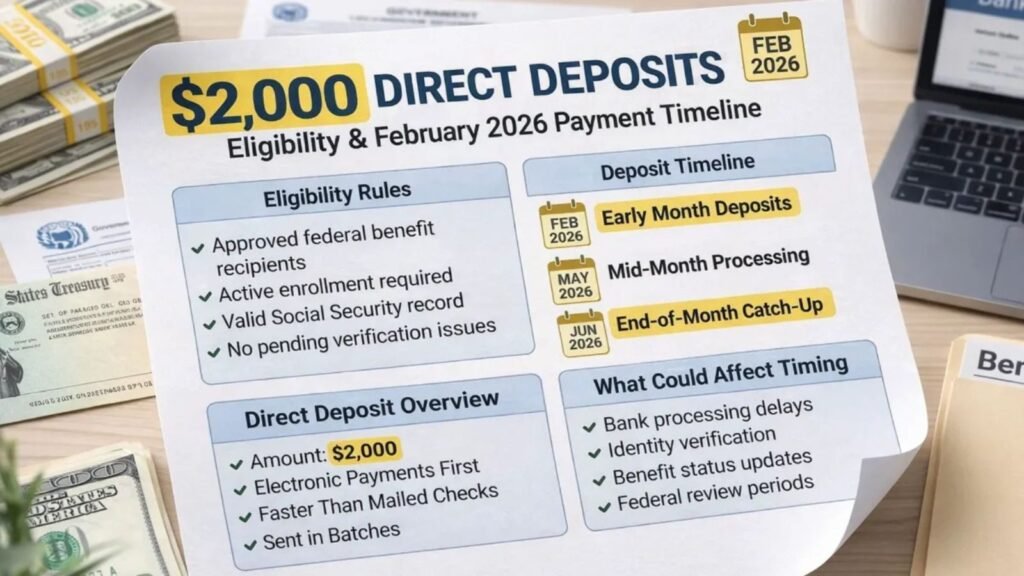

As February 2026 gets closer, many Americans are coming across headlines and social media posts talking about a possible $2,000 Direct Deposit February 2026 payment. It’s completely understandable why this has caught people’s attention. With rising living costs, inflation concerns, and ongoing economic uncertainty, the idea of receiving a $2,000 Direct Deposit February 2026 sounds like welcome financial relief. Naturally, questions are circulating everywhere: Is this payment officially approved? Who qualifies? When will it arrive? Is everyone eligible?

At this time, there is no newly approved nationwide stimulus program guaranteeing a universal $2,000 Direct Deposit February 2026 for all Americans. The amount being discussed online is generally tied to existing federal programs, routine tax refunds, or regularly scheduled benefits that certain individuals may receive based on their personal eligibility. In other words, while some people may indeed see deposits around that amount in February, it is not a blanket payment issued to every citizen.

Understanding the truth behind the $2,000 Direct Deposit February 2026 discussion requires breaking down where this number comes from, how federal payments actually work, and why eligibility varies from person to person. Let’s take a closer, detailed look at what’s really happening.

2026 GMC Sierra 1500 Reveals Bold Upgrades in Power and Premium Design

Where the $2,000 Amount Comes From

The figure often associated with the $2,000 Direct Deposit February 2026 conversation is not random. In many cases, it reflects common payment amounts that individuals already receive through standard federal processes. These may include income tax refunds, Social Security retirement benefits, Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), or certain veterans’ benefits.

For taxpayers, refunds frequently reach or exceed $2,000 depending on income level, tax credits claimed, and how much was withheld from paychecks during the year. When people file their 2025 tax returns in early 2026, some may see a refund deposited in February that happens to be close to $2,000. That deposit might be described online as a $2,000 Direct Deposit February 2026, even though it is simply a regular tax refund.

Similarly, retirees receiving Social Security benefits may receive monthly payments that approach or surpass $2,000, particularly if they had higher lifetime earnings and delayed claiming benefits until full retirement age or later. Cost-of-living adjustments (COLAs) also increase benefit amounts over time. As a result, some beneficiaries may see a February payment around that level, which could be mistaken for a special $2,000 Direct Deposit February 2026 initiative.

It’s important to understand that these payments are individualized. They are calculated based on personal earnings history, tax filings, and eligibility requirements. There is no flat, automatic $2,000 Direct Deposit February 2026 being distributed universally.

Tax Refunds and How They Work

One of the most common sources of a deposit near $2,000 in February is a federal income tax refund. A tax refund occurs when you have paid more in taxes throughout the year than you actually owe. This can happen because of paycheck withholding, estimated tax payments, or refundable tax credits.

When you file your return, the IRS calculates your total tax liability. If you overpaid, the difference is refunded to you. For many families, refundable credits such as the Child Tax Credit (CTC) or the Earned Income Tax Credit (EITC) significantly increase the refund amount. In some cases, this can result in a deposit that resembles a $2,000 Direct Deposit February 2026 payment.

Electronic filing combined with direct deposit is the fastest way to receive a refund. The IRS typically issues refunds within about 21 days after accepting a return, although some returns require additional review. Early filers who submit accurate returns in late January may indeed receive deposits during February. If that refund equals roughly $2,000, it may appear online as confirmation of a $2,000 Direct Deposit February 2026, even though it is simply the normal tax process at work.

However, refund timing can vary. Errors, identity verification requirements, or additional review for certain credits may delay payment. That’s why it’s essential not to assume that every taxpayer will receive a $2,000 Direct Deposit February 2026 in the same timeframe—or at all.

Social Security Retirement Benefits

Another major source of confusion surrounding the $2,000 Direct Deposit February 2026 discussion involves Social Security retirement payments. Social Security benefits are based on your highest 35 years of earnings, adjusted for inflation. The amount you receive depends on how much you earned over your lifetime and the age at which you begin collecting benefits.

For individuals who had strong earnings histories and waited until full retirement age—or even delayed benefits until age 70—monthly payments can approach or exceed $2,000. When February payments are deposited according to the standard schedule, recipients may see amounts near this level. This can lead to assumptions that a new $2,000 Direct Deposit February 2026 program has been launched.

In reality, these are routine benefit payments. Social Security follows a structured schedule based on the recipient’s birth date. Payments are not random, nor are they newly created stimulus checks. The $2,000 Direct Deposit February 2026 narrative often simply reflects regular monthly distributions.

Disability Benefits and SSI Payments

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) are also sometimes connected to the $2,000 Direct Deposit February 2026 rumors. SSDI payments depend on prior work credits and earnings history. Individuals with higher lifetime earnings may receive larger disability benefits, potentially approaching the $2,000 range.

SSI, on the other hand, is income-based and generally provides lower monthly amounts than SSDI. However, some recipients who qualify for additional state supplements may see higher totals.

It’s important to note that these programs operate under strict eligibility criteria. Not everyone qualifies, and payment amounts vary significantly. Therefore, while some beneficiaries may receive a deposit near $2,000 in February, it is not part of a new universal $2,000 Direct Deposit February 2026 initiative.

Veterans Benefits and Other Federal Payments

Certain veterans’ benefits may also result in monthly deposits near $2,000, depending on disability ratings and service history. These payments are administered through the Department of Veterans Affairs and are calculated individually.

As with Social Security and tax refunds, these deposits are routine and based on established formulas. They are not new stimulus payments labeled as $2,000 Direct Deposit February 2026.

Understanding this distinction is critical. Federal benefits are structured programs with defined rules. They are not one-size-fits-all checks distributed to every American.

Why Not Everyone Will Receive $2,000

One of the biggest misconceptions surrounding the $2,000 Direct Deposit February 2026 topic is the assumption that everyone will receive the same amount. Federal payments do not work that way.

Tax refunds depend on individual income, deductions, and credits. Social Security benefits depend on lifetime earnings and retirement age. Disability benefits depend on medical eligibility and work history. Veterans benefits depend on service records and disability ratings.

As a result, some individuals may receive around $2,000, others may receive more, and many may receive less—or nothing at all beyond their regular benefits. The phrase $2,000 Direct Deposit February 2026 does not represent a guaranteed or universal payment.

Protecting Yourself from Misinformation and Scams

Whenever discussions about large payments circulate online, misinformation spreads quickly. Unfortunately, scammers often take advantage of confusion surrounding topics like $2,000 Direct Deposit February 2026.

Fraudulent messages may claim that you need to “apply immediately” or provide personal information to receive your deposit. Official government agencies such as the IRS or Social Security Administration do not request sensitive details through random social media messages, emails, or text links.

If you want accurate information about your eligibility for any potential $2,000 Direct Deposit February 2026-related payment, rely only on official government websites and secure online accounts. Avoid clicking on suspicious links or sharing personal data with unverified sources.

How to Stay Informed

The best way to determine whether you will receive a payment in February is to review your official accounts. Taxpayers can monitor refund status through their IRS account once returns are filed. Social Security recipients can check benefit details through their official online portal.

Rather than relying on viral posts about $2,000 Direct Deposit February 2026, it’s wiser to verify information directly from trusted government sources. Payment schedules and eligibility rules are clearly outlined by federal agencies.

Staying informed through official channels helps eliminate confusion and reduces the risk of falling victim to scams.

Conclusion

To summarize, there is currently no confirmed universal stimulus program guaranteeing a $2,000 Direct Deposit February 2026 for all Americans. Most deposits near that amount are routine tax refunds, Social Security payments, disability benefits, or veterans benefits calculated individually based on eligibility.

While some people may indeed see a deposit around $2,000 in February, it is not a new nationwide initiative. Understanding how federal payments work can prevent confusion and unnecessary expectations.

The smartest approach is to review your official IRS or Social Security account, file accurate tax returns, and rely on verified announcements. That way, you can determine whether any upcoming payment applies specifically to you.

Disclaimer: This article is for informational purposes only and does not provide tax, legal, or financial advice. Payment amounts and eligibility depend entirely on individual circumstances and official program rules. Readers should consult official government sources or qualified professionals for guidance tailored to their personal situation.